késleltetett adatok

Take the crazy ways - Mainelli, father of global indexes recommends to Budapest

- Mr. Mainelli, the indices you created track the big leaps global centres can make in the modern world, while you are also famous for having renovated a Thames sailing barge with your wife, and you were the sheriff of London last year. So, what does the word ‘tradition’ mean to you?

- Tradition to me is very much the continuity that we provide both backward and forward in time, from our ancestors to our posterity. There is a famous English humorous question: what has posterity ever done for me? Well, those of us who believe in sustainability have to believe in posterity, a community of people stretching from our ancestors to our distant descendants. Sustainability is being part of a long-lived and very wide community. When my wife and I decided to buy a Thames sailing barge, Lady Daphne, in 1996, we became part of the sailing barge community. Lady Daphne is a 27-metre boat that can hold about 220 tonnes of cargo. You might say, why would we buy that? This is the most traditional boat still sailing in London, there are only about 20 of them still sailing, but we continue to sail them, and, interestingly, to race them. The oldest racing in the world among sail boats is with these enormous trade vessels. One match, the Thames Match, dates back to 1863. We decided that we are going to save one, and we restored it from 1996 to 2017, when it was time to hand it on. That was part of tradition, too. The wider community has been revitalized. Later we raised sufficient money get an older boat back into action again, and to build a new cargo vessel for training young adults. The Sea Change Sailing Trust programme mixes up well-off youths with disadvantaged youths. Our two daughters went sailing for a week delivering cargo on this boat, the Blue Mermaid.

- You are expected to become lord mayor of London, there can be nothing more traditional than that.

- The City of London is the world's oldest continuous democracy. The elections of sheriffs began, we believe, around 640 AD, and they have been almost continuous apart from a brief period in the 11th century. Workers have always had a vote. We have 25 wards that go back over a thousand years and thus we’re extremely proud, fiercely proud, of them. I'm the Alderman for Broad Street ward. Each year one Alderman is elected as lord mayor. I will have a year to promote our workers' cooperative, and promote the idea that London is a place where people can come and do business freely; we are welcoming and open. I will be visiting approximately 25 countries to get that message out. You do live in the Mansion House for a year, and you do wear traditional, sometime flummery, dress, but it is a very serious job. The estimate is that you make about 2,200 presentations during a year. It is an unpaid job, but the opportunity to do something good for our community is priceless.

- From tradition to the future: you have established the Global Financial Centres, Green Finance and Smart Centres indices. Do we live on the past or the future?

- My outlook is most often as liberal, not in the political sense, but in the philosophical sense. Liberals tend to believe in progress: the future could be better than the past, if you put work into it. My firm, Z/Yen is a research firm. We do a tremendous amount of science research, but we are more famous for our economic and market research. The three indices we conduct every six months are quite popular. Interestingly, by being a core measure of progress, these indices help to shape and grow the financial, green finance, and intellectual communities of commercial centres. When we began the indices back in 2005 - it may sound surprising – there was no standardised evaluation of how financial centres were doing. One of the unique features about our indices is that the factor weightings are provided statistically by the people who provide the assessments, using machine-learning techniques similar to those that recommend goods for you to buy, not by Z/Yen who compiles it. So we don't have any influence on whether a financial centre seems to be stronger because it has a large stock market, or they seem to be stronger because they have a lot of wealth managers. Initially, people were very competitive, overly competitive, trying to abuse the index and place their centres higher. “That's the wrong place. We don't belong there”. Over time, as people came to realize the index is about as unbiased as it can be, Z/Yen has no control over the index weightings, they began to realise that getting an accurate independent assessment of their progress was far more important.

We came out with the idea of the Green Finance Index a long time ago, but we could only get funding about six years ago. And once it got going, various financial centres began to say how could we be more green. Which is perfect, that is what we were trying to achieve, to get people to focus on sustainability, to want to improve, and to exchange ideas. Likewise, the same increasing index importance has happened as cities realise that being ‘smart’, i.e. being able to develop and deploy technology, is urgent if they want to address the big problems facing society such as the UN’s Sustainable Development Goals. The Smart Centres index is a recognition too that the nature of finance is changing from being a vertical industry sector alongside industry, it is now turning into a more horizontal industry, supporting everyone and more quietly than it used to. A lot of it is payment and processing, international currency exchange, straightforward insurance, boring, utility things, really being done by computers and programmers. Finance is increasingly commoditized. It's everywhere and nowhere. Let's call it embedded finance. So if I put together a new application on a mobile phone, or I put on something in the Metaverse, sure somebody has to pay something, but it’s a simple plug-in to my app or virtual reality, not a system of its own. The Smart Centres Index tried to measure the growth of these new applications and technologies, not an easy task as they are complex and distributed, and now increasingly being provided from multiple locations. Still, our six monthly indices are important for policy makers, city promoters, economists, and strategic planners. Our indices influence many large decisions, particularly where people want to locate. We do a fair amount of relocation work with financial firms answering questions such as “where do we want to go in Asia”, or ‘what should our offices specialise in, where?” There are about a 150 factors in each of our indices, they are really quite detailed. That's a lot of information to analyse and absorb, but these are big decisions.

- How do you see the dynamics, are there new centres emerging in the world? How do Central European centres stand?

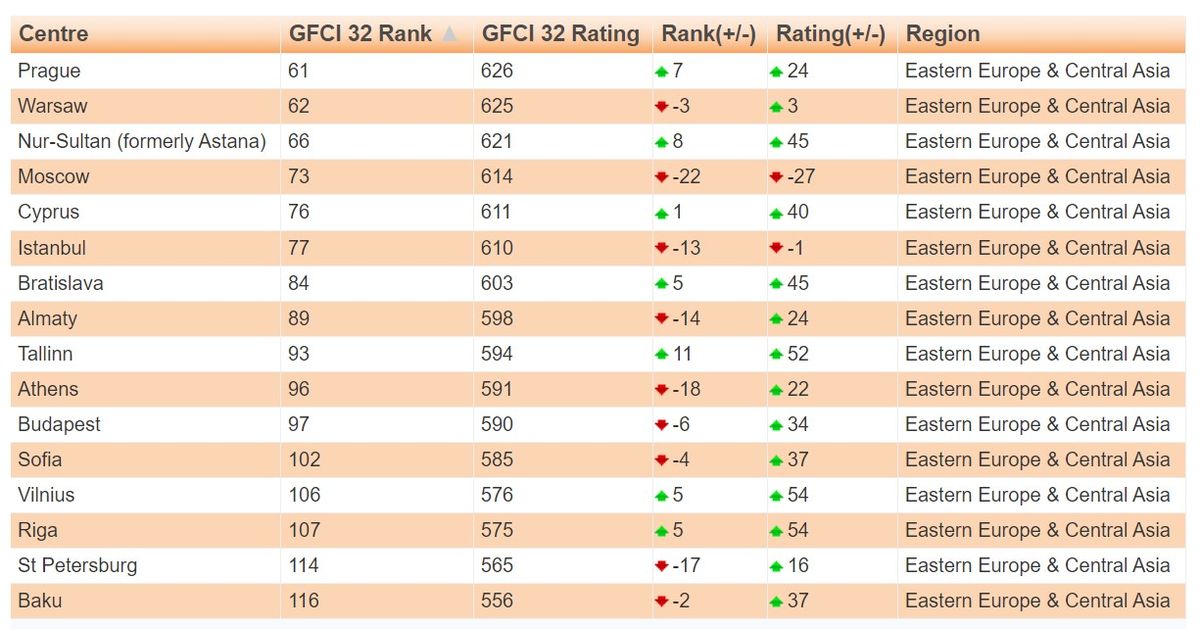

- Back in 2005 when we began our research, we examined 46 centres. In the latest edition, published Thursday, we have 119 centres. Some people accuse us of loosening our standards. Actually no, the community rates whom to include, not us. And if we go back to 2005, we had only 2 Chinese centres. Today 13. If you are a policy maker looking to revitalise your city or catch up with the modern world, finance is one of the easier things to get going. If you have some trade going on, there is a lot you can do to create additional, useful financial activity. Many of the people at today's conference will focus on capital. Capital is great, but before capital comes trade. You could have a lot of wealthy people are sitting in a tropical island somewhere, and still not have a financial centre. It's the trade that's starts it. Capital comes in later. By the time you have a stock exchange, you are already a financial centre. Policy makers love developing finance, because it doesn't require as much effort as other economic sectors to get going. You need a bit of essential infrastructure, some trained people, some IT, and some sensible, fair regulation. It's an easy win. From a Eurasian perspective, everybody is doing it. And there are a lot of new places in the world now recognised as financial centres, Budapest, Warsaw, or Astana for example, that weren’t financial centres back in 2005. Interestingly, despite being a new centre, Astana performs quite well in the indexes, even above Budapest. Budapest does quite well in the Smart Centres Index. I think what’s great about Budapest is the realisation that things are not only about the local economy. Dubai and Abu Dhabi emerged from the sands by becoming hubs and are now very well-established. Connectivity across Asia will help make Budapest a hub. Remember that every financial transaction is an act of cooperation. There are always two sides, so financial centres, particularly hubs, cooperate at least as much as they compete.

In Eurasia I believe that there are good opportunities to increase offerings and compete. Probably the biggest one is on energy. There has never been a proper energy interchange in Asia. Kazakhstan has been promoting a Eurasian Renewable Energy Internet. They know it’s useless if it’s just a Kazakh renewable energy internet. The more who participate, the more who win. Another area based on networks and finance is clearly rail. Post the Ukrainian-Russian conflict we should turn hopefully to looking at finance and rail interchange because of the landlocked nature of many of the nations. In both of these areas I think there are tremendous opportunities to grow financial centres.

- How would you compare the dynamics in Asia, emerging Europe and Western Europe? Are we going upwards?

- Central Europe has as many opportunities as everybody else. Looking back to 2005 again, the Chinese centres were not big enough for people to notice, and now many of them are in the top 10 or top 20. So it can be done in less than 20 years, if a centre truly has the desire and the willpower. In Central Europe, Poland has done a particularly good job. What Hungary has been doing, trying to be open both to the EU and to its neighbours to the East, has been a good policy. We need to help our local community thrive, our neighbouring nations success helps us win. I'm quite positive about Central Europe. Things have come a very long way in 32 years from when I was working in Prague to save the retail banking sector. Sometimes we get impatient and we forget that while it's been a rocky road, it is completely different now. Central European countries have become truly European countries.

- Do you think the ongoing bipolarization of the world can reverse globalization regarding trade and the emergence of financial centres?

- It is very difficult to see globalization in its vaguer form disappear. Trade as a % of GDP, thus taking population growth into account, has risen from 27% in 1970 to 60% in 2019, a 220% rise over the past half century. People like to talk about the improvement in lifestyles, technology, mobile phones, PCs, vaccines, motorcars, but actually trade has probably been mostly responsible for the revolutionary improvement in living standards. We need trade. But you are right to point out that we are in a much more bipolar world, with people asking us to join various camps. There might be a bit of deglobalization, but firms are opening up extra supply chains. ‘Brittle’ supply chains are becoming more ‘supple’ as companies put more ‘fat into the system’. Instead of getting everything from China, a firm, while not leaving China, is going to open extra capacity, logistics, and other links in India or in Brazil, or America or Indonesia, Africa. From a financial centre point of view that’s great, more complexity, more trades, more transactions.

Going back to Budapest, and its potential: the truly global financial centres are frequently smaller places. Singapore is not particularly large, nor Amsterdam, or many offshore centres. Switzerland, where Zurich and Geneva are strong in our index, has only nine million people. And here we are in Hungary with ten million people. In the old times, back in the 80s, when you read literature on how financial centres developed, the belief was that you start with a basic economy, then you build a really big economy, and then you get a financial centre. Well, that's not true. There are two types of financial centres. One type supports a domestic economy, the other type is the international hub. I think Budapest has a chance to become one of those hubs. Like Singapore in Asia or London in Europe, Budapest might become ‘local everywhere in Eurasia’. My test for a truly international hub? I don't know anybody in 40-plus years of working in finance, who went to New York, or to Tokyo, or to Beijing or to Shanghai to do a deal, where they don't have a local, domestic interest, a local component. Singapore and London in particular, but also Zurich, Geneva, or Amsterdam, are places people frequently go there to do a deal with no local interest at all. They just like the regulatory environment, the law firms, accountants, courts, arbitrators, and other facilities. A deal is done in these hubs that has nothing to do with the domestic economy. Hungary could genuinely grow into that hub role for Eurasia. In most countries about 5 percent to 6 percent of ‘normal’ GDP is finance. In these hub centres it is more like 10 percent. And it makes a city much more wealthy, much more succcessful, much more interesting.

- About the Green Finance Index: the European energy crisis seems to have reversed a drift away from dirty energy. Are there more important things? Will coal bonds replace green bonds?

- That's a very interesting point. I'm a committed environmentalist since the late 70s. And I'm also committed to economic growth. The difficulty on coal bonds just now is longevity. A typical bond, particularly something for energy, tends to be long-dated. You’re looking at 10 or 15 years. If this energy crisis persists for another 3 years or so, then I think you will see coal bonds. But if it is temporary, the gas is turned back on, the Germans develop their LNG facilities, they get to alternative sources, etc, we might see things return to normal without them, and a renewed focus on the Net Zero 2050 targets that were all the rage at COP27 in Glasgow last December.

- Do you think it is temporary?

- That's a geopolitical question outside of my domain. I didn't see the Ukrainian-Russian Conflict coming. I certainly do hope the Conflict will be short. Sadly, a statistical evaluation says there is a significant likelihood of it becoming a ‘forever war’, a long-running conflict, unless there is a significant regime change in Russia.

- About the Smart Centres Index: do you see the idea spreading?

- Advancement is increasingly about the ability of a city or a centre to grow its intellectual capacity, and do something with it, in particular to create businesses with new technologies. The point is really to add value. The world is changing in a lot of funny ways. The brainy, value-adding businesses are not just office businesses. For example, years ago, I used to be in charge of a small titanium research smelter. We could smelt about 15 to 25 kilos. The Russians could smelt much more. We were jealous. But last year I saw a titanium smelter in the UK that can do 200 kilos, heading for 400 kilos. Titanium is cheap, about 20 pounds a kilo. But smelted into forms, it is more like 2,000 pounds a kilo. 1,980 pounds from the brain power put into some raw material. Smart Centres Index look at all sorts of crazy ways to take ideas and technology and turn them into businesses that add value, from manufacturing to entertainment. Hungary has always been a centre of intellect, brain power, and creativity. Hungary can easily grab the opportunities of a smart centre, and rise yet more rapidly.

Is the idea spreading? Yes, definitely. We notice that people call us up more frequently and ask for more information on where they could do better. They are beginning to understand that finance is changing, and now they need to work on the next generation of small and medium-sized enterprises (SMEs). Ultimately, from an economic point of view, long-term successful cities are gigantic SME creation engines. Forget the giants of today, they can take care of themselves. In London we definitely saw that, 36 years ago none of these big banks were in London. So it can happen very rapidly. Today, just the City of London nurtures some 24,000 SMEs with some 250,000 workers out of the 500,000 that work in the Square Mile. Smart SMEs in smart centres, those are our future.

You can read the Hungarian version of this interview here.

Portfóliónk minőségi tartalmat jelent minden olvasó számára. Egyedülálló elérést, országos lefedettséget és változatos megjelenési lehetőséget biztosít. Folyamatosan keressük az új irányokat és fejlődési lehetőségeket. Ez jövőnk záloga.