késleltetett adatok

Slow Growth and Short Tails

The good news is that economic performance will pick up modestly in both advanced economies and emerging markets. The advanced economies, benefiting from a half-decade of painful private-sector deleveraging (households, banks, and non-financial firms), a smaller fiscal drag (with the exception of Japan), and maintenance of accommodative monetary policies, will grow at an annual pace closer to 1.9%.

Moreover, so-called tail risks (low-probability, high-impact shocks) will be less salient in 2014. The threat, for example, of a eurozone implosion, another government shutdown or debt-ceiling fight in the United States, a hard landing in China, or a war between Israel and Iran over nuclear proliferation, will be far more subdued.

Still, most advanced economies (the US, the eurozone, Japan, the United Kingdom, Australia, and Canada) will barely reach potential growth, or will remain below it. Households, banks, and some non-financial firms in most advanced economies remain saddled with high debt ratios, implying continued deleveraging. High budget deficits and public-debt burdens will force governments to continue painful fiscal adjustment. And an abundance of policy and regulatory uncertainties will keep private investment spending in check.

The outlook for 2014 is dampened by longer-term constraints as well. Indeed, there is a looming risk of secular stagnation in many advanced economies, owing to the adverse effect on productivity growth of years of underinvestment in human and physical capital. And the structural reforms that these economies need to boost their potential growth will be implemented too slowly.

While the eurozone’s tail risks are lower, its fundamental problems remain unresolved: low potential growth; high unemployment; still-high and rising levels of public debt; loss of competitiveness and slow reduction of unit labor costs (which a strong euro does not help); and extremely tight credit rationing, owing to banks’ ongoing deleveraging. Meanwhile, progress toward a banking union will be slow, while no steps will be taken toward establishing a fiscal union, even as austerity fatigue and political risks in the eurozone’s periphery grow.

In Japan, Prime Minister Shinzo Abe’s government has made significant headway in overcoming almost two decades of deflation, thanks to monetary easing and fiscal expansion. The main uncertainties stem from the coming increase in the consumption tax and slow implementation of the third “arrow” of “Abenomics,” namely structural reforms and trade liberalization.

In the US, economic performance in 2014 will benefit from the shale-energy revolution, improvement in the labor and housing markets, and the “reshoring” of manufacturing. The downside risks result from political gridlock in Congress (particularly given the upcoming midterm election in November), which will continue to limit progress on long-term fiscal consolidation; a lack of clarity about the Federal Reserve’s planned exit from quantitative easing (QE) and zero policy rates; and regulatory uncertainties.

Emerging markets’ difficult year in 2013 reflected several factors, including China’s economic slowdown, the end of the commodity super-cycle, and a fall in potential growth, owing to delays in launching structural reforms. Moreover, several major emerging economies were hit hard in the spring and summer, after the Fed’s signal of a forthcoming exit from QE triggered a capital-flow reversal, exposing vulnerabilities stemming from loose monetary, fiscal, and credit policies in the boom years of cheap money and abundant inflows.

Emerging economies will grow faster in 2014 – closer to 5% year on year – for several reasons. Brisker recovery in advanced economies will boost imports from emerging markets. The Fed’s exit from QE will be slow, keeping interest rates low. Policy reforms in China will attenuate the risk of a hard landing. And, with many emerging markets still urbanizing and industrializing, their rising middle classes will consume more goods and services.

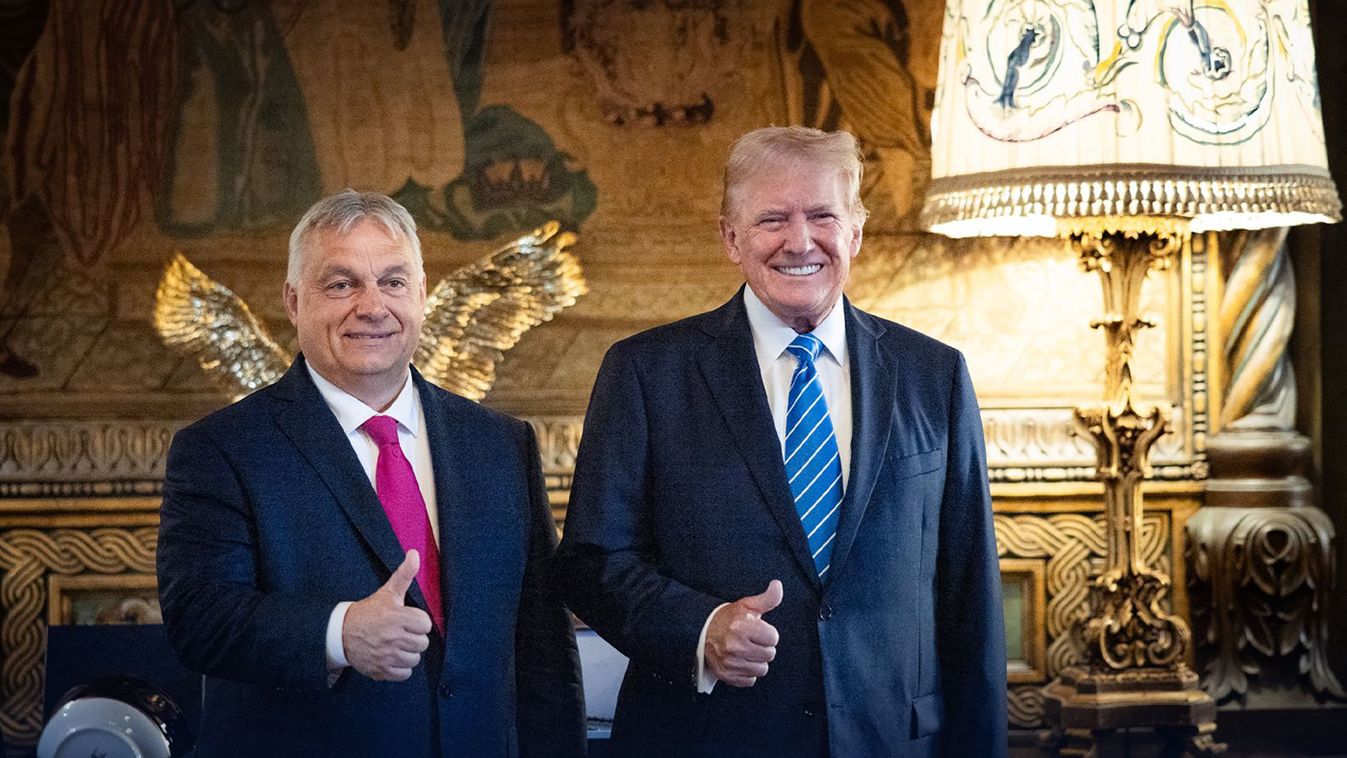

Still, some emerging markets – namely, India, Indonesia, Brazil, Turkey, South Africa, Hungary, Ukraine, Argentina, and Venezuela – will remain fragile in 2014, owing to large external and fiscal deficits, slowing growth, below-target inflation, and election-related political tensions. Some of these countries – for example, Indonesia – have recently undertaken more policy adjustment and will be subject to lower risks, though their growth and asset markets remain vulnerable to policy and political uncertainties and potential external shocks.

The better-performing emerging markets are those with fewer macroeconomic, policy, and financial weaknesses: South Korea, the Philippines, Malaysia, and other Asian industrial exporters; Poland and the Czech Republic in Europe; Chile, Colombia, Peru, and Mexico in Latin America; Kenya, Rwanda, and a few other economies in Sub-Saharan Africa; and the Gulf oil-exporting countries.

Finally, China will maintain an annual growth rate above 7% in 2014. But, despite the reforms set out by the Third Plenum of the Communist Party’s Central Committee, the shift in China’s growth model from fixed investment toward private consumption will occur too slowly. Many vested interests, including local governments and state-owned enterprises, are resisting change; a huge volume of private and public debt will go sour; and the country’s leadership is divided on how quickly reforms should be implemented. So, while China will avoid a hard landing in 2014, its medium-term prospects remain worrisome.

In sum, the global economy will grow faster in 2014, while tail risks will be lower. But, with the possible exception of the US, growth will remain anemic in most advanced economies, and emerging-market fragility – including China’s uncertain efforts at economic rebalancing – could become a drag on global growth in subsequent years.

Copyright: Project Syndicate, 2013.

www.project-syndicate.org

Portfóliónk minőségi tartalmat jelent minden olvasó számára. Egyedülálló elérést, országos lefedettséget és változatos megjelenési lehetőséget biztosít. Folyamatosan keressük az új irányokat és fejlődési lehetőségeket. Ez jövőnk záloga.